- info@prototypeshlh.com

- +86-133-9285-9203

- Room 2003, 20th Floor, Xingji Building, Shangde Road, Shajing Street, Bao'an District, Shenzhen

SERVICES

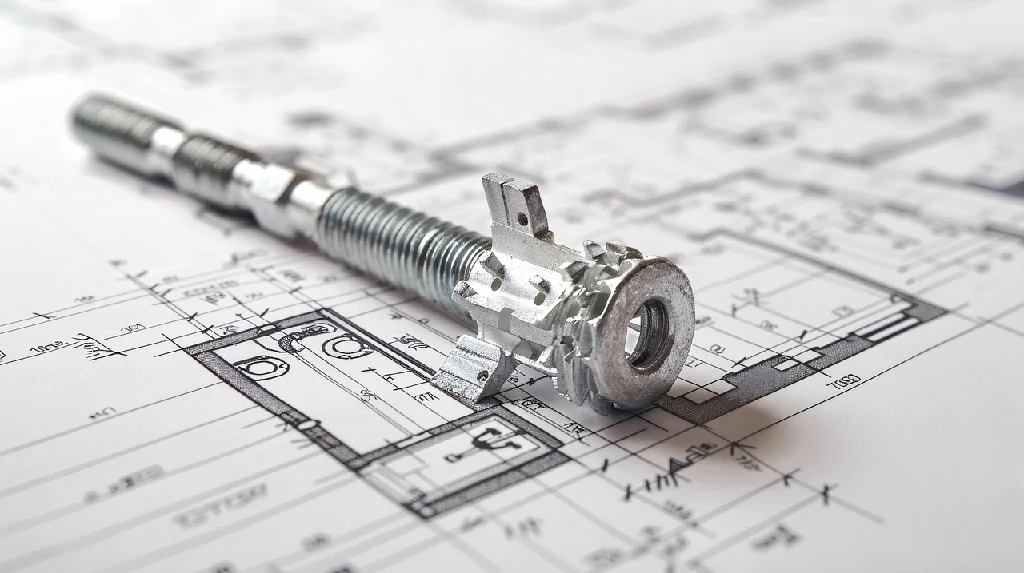

CNC Machining Service

Tight tolerances and finishing capabilities, as fast as 2 days.

Vacuum Casting Service

Production quality parts without the tooling investment.

Sheet Metal Fabrication

Experience the versatility 6 cost efficiency withflexible application options.

Die Casting Service

Create high quality custom mechanicals withprecision and accuracy.

Injection Molding Service

Production-grade steel tooling, as fast as weeks.

Carbon Fiber Manufacturing

Composite materials, such as carbon fiber reinforced plastics are highly versatile and efficiert materials.

Popular Services

Injection Molding Service

A faster, easier way to order high-quality injection molded parts that accelerates iteration, testing, and scaled production. Upload your designs for DFM feedback and pricing in 24 hours.

3D Printing Service

Our 3D printing solutions cater to personalised needs with a diverse range of materials and colour options, including SLA, SLS, FDM, Projet, DMLS, and MJF printing services.

Surface Finishing

The easiest way to source your custom parts, with 15+ surface finishing options.

Design Guide

In-depth design guides full of best practices for all of HLH's manufacturing processes.

Case Studies

Success stories from innovativecompanies using HLH.

Blog

lndustry trends, company news andproduct updates.

Featured Posts

Aerospace & UAV

HLH is your 3D manufacturing partner from prototype to large scale production.

Consumer Products

New Product Introduction Solutions for Consumer Products.

Automotive

New Product Introduction Solutions for Automotive.

Industrial Machinery

The main purpose of industrial prototyping is to take the product from drawings into the real world.

Robotics & Automation

Need some assistance bringing your robotic device or parts from the sketch-board to reality?

Medical Devices

The medical industry needs high quality, dependable and safe parts and products.

Communications

We understand the demands and ever changing landscape of the communications industry.

Product Development

Industrial design and engineering consultancies are some of the most innovate and creative enterprises on the planet.

Today's global manufacturing landscape stands at an unprecedented and complex crossroads. On one side, there is the acute pain of supply chain disruptions and rising costs driven by geopolitical turbulence and rising trade barriers. On the other, the wave of the Fourth Industrial Revolution, represented by artificial intelligence and additive manufacturing, brings an efficiency revolution and paradigm shifts. Custom parts manufacturing, the segment that best embodies the qualities of "precision" and "flexibility" in the modern industrial system, is at the forefront, experiencing this trial by fire and ice. This article, based on the latest facts and data, analyzes how global dynamics are profoundly impacting this industry and explores its evolutionary path amid uncertainty.

In recent years, the consensus on "globalization" has been replaced by new narratives like "regionalization" and "friend-shoring." The most direct manifestation of this is the drastic adjustment of tariff policies. Taking aluminum, a key industrial raw material, as an example, global aluminum trade patterns have been in constant flux since the U.S. initiated its "Section 232" investigation and imposed tariffs in 2018. In 2025, the U.S. further increased import tariffs on aluminum products from 25% to a significant 50%, rescinding exemptions for traditional allies like Canada and Mexico, and even extending tariffs to aluminum-containing derivative products like appliances and machinery components.

The impact of such policies is immediate. Data shows that from January to August 2025, U.S. imports of unwrought aluminum plummeted by 244,000 metric tons year-on-year, with exports from Canada, its largest supplier, falling by approximately 432,000 metric tons. While high tariffs temporarily raised domestic U.S. aluminum prices, they also significantly suppressed demand, leading to a reduction of about 400,000 to 500,000 metric tons in the total supply of imported aluminum units. This forced redirection of "trade flows" compels producers like Canada to redirect over 150,000 metric tons of unwrought aluminum to non-U.S. markets like Europe, triggering a chain reaction in global raw material supply and demand patterns.

Tariffs are just the tip of the iceberg. The deeper impact lies in the expectations and behavioral patterns of manufacturing enterprises. According to the GEP Global Supply Chain Volatility Index, under the shock of tariffs, global manufacturers widely anticipated weak future demand, leading to a sharp reduction in purchases of raw materials and components. In April 2025, global material procurement volumes hit a low. To cushion the blow, North American manufacturers were forced to stockpile large safety inventories, while factory activity in major Asian export hubs like China, Taiwan, and South Korea also noticeably slowed. This cycle of "contracted expectations — reduced production — inventory hoarding" exacerbates supply chain volatility and uncertainty.

Research by Boston Consulting Group (BCG) clearly states that geopolitical risk has leaped from a secondary concern to one of the top five challenges facing manufacturing executives. For custom parts manufacturers, this means greater volatility in customer orders, more difficult production planning, and increasingly unstable costs and lead times for raw material procurement. Industry experts observe that sourcing traditional custom parts like castings, forgings, and extruded profiles is becoming increasingly challenging.

Faced with immense external pressure, the custom parts manufacturing industry is not sitting idle but demonstrating remarkable self-adaptive capacity. Its survival and evolution are unfolding along two main lines: the restructuring of geographical footprints and the migration of production technologies.

In terms of geographical layout, "reshoring" and "nearshoring" have become keywords. Companies are reassessing past offshore outsourcing strategies based purely on low cost, shifting instead towards seeking supply chain resilience and controllability. For example, a report from the American Mold Builders Association (AMBA) indicates that despite foreign competition and cost pressures, 72% of U.S. mold makers are considering entering new, more stable markets less affected by tariffs, such as aerospace and defense, to diversify their business. This move of relocating production closer to end markets or within political alliances is a direct response to geopolitical risks.

A more profound transformation is occurring at the technological level. When traditional supply chains develop "fault lines," digital manufacturing technologies like 3D printing (additive manufacturing) rapidly evolve from a "complementary" method to a critical "alternative" solution. Their value is magnified infinitely during turbulent times:

The essence of this "technology migration" is a shift from pursuing the economies of scale of "mass standardization" to embracing the economies of scope and speed of "low-volume personalization." It makes manufacturing less reliant on forecasting and stockpiling, instead building on real-time response and on-demand production.

Synthesizing the current shocks and the industry's responses, a new manufacturing paradigm for the future is emerging. Its core differences from the traditional model are summarized in the table below:

| Dimension | Traditional Manufacturing Paradigm | Emerging Manufacturing Paradigm |

|---|---|---|

| Production Logic | Forecast-based, pursuing large-batch economies of scale. | Response-based, excelling at low-volume economies of scope. |

| Organizational Model | Centralized, long-chain, reliant on low-cost labor. | Distributed, short-chain, reliant on digital skills. |

| Supply Chain Core | Cost and static efficiency. | Resilience and dynamic agility. |

| Technological Foundation | Subtractive manufacturing (CNC), mold-dependent. | Integration of additive & subtractive, driven by digital models. |

| Competitive Core | Cost control and delivery reliability. | Speed, customization capability, and supply chain autonomy. |

This paradigm is supported by the convergence of multiple technologies and changes in talent structure. The Industry 5.0 concept emphasizes human-machine collaboration, combining workers' experiential wisdom with the precision and efficiency of AI and robots to achieve a higher level of personalized customization. Artificial intelligence and digital twin technologies enable remote monitoring, predictive maintenance, and virtual commissioning, enhancing management precision and risk resistance.

However, the greatest challenge may come from talent. The manufacturing industry, especially in experience-intensive fields like forging, casting, and extrusion, faces a dual squeeze from a wave of retiring skilled workers and a lack of interest from younger generations. Future manufacturing engineers will need both traditional materials/process knowledge and digital skills. Cultivating such interdisciplinary talent requires earlier and deeper collaboration between industry and education.

The turbulence of the global situation acts like a "stress test" on the skeleton of global manufacturing. For custom parts manufacturing, tariffs and geopolitics directly impact its cost structure and supply chain stability, causing short-term pain. On a deeper level, however, this pressure is accelerating a profound transformation: the anchor point of manufacturing value is shifting from "globalized efficiency" to "regionalized resilience" and "digitalized agility."

Enterprises that proactively embrace "technology migration," deeply integrate digital manufacturing technologies like 3D printing into their production systems, and actively invest in intelligence and talent development will not only weather the storm but also have the opportunity to define the future in the reshaping of the next decade's global manufacturing landscape. Custom parts manufacturing, once a "behind-the-scenes hero," is now, in the fission of global dynamics, stepping to the center stage, becoming a key link determining the resilience and competitiveness of the entire industrial system.

Emali: info@prototypeshlh.com